Debt Relief Specialist wants to share a settlement letter from Discover. Bal. $15,780.15 Offer $10,720.00 Savings $5060.15

Debt Relief Specialist wants to share a settlement letter from Discover. Bal. $15,780.15 Offer $10,720.00 Savings $5060.15

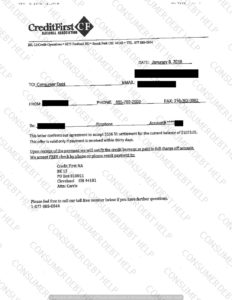

Debt Relief Specialist wants to share a settlement letter from Credit First Bank. Bal. $1073.01 Offer $536.51 Savings $536.50

Debt Relief Specialist wants to share a settlement letter from Credit First Bank. Bal. $892.48 Offer $446.24 Savings $446.24

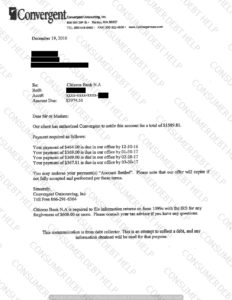

Debt Relief Specialist wants to share a settlement letter from Citizens Bank.

Bal. $3974.51 Offer $1589.81 Savings $2384.70

Debt Relief Specialist wants to share a settlement letter from Citizens Bank.

Bal. $2900.94 Offer $2088.68 Savings $812.26

Debt Relief Specialist wants to share a settlement letter from Dell Financial. Bal. $7559.97 Offer $3024.00 Savings $4535.97

Staying out of debt should be the goal of every consumer. The problem is that staying out of debt has been given the bad reputation of being no fun. Many consumers associate the concept of financial responsibility with denying themselves the things they want in life. The truth is that using practical tips to stay out of debt can help you to better understand how to have the things you want in life without damaging your financial situation.

Personal financial planning is a two-step process. The first step is to develop the spending and saving policies that will dictate how you handle your finances. Once you have your policies in place, you need to develop the dedication necessary to stay with those policies and learn from them. Rather than fighting the urge to spend money, you should be taking the time to understand how good spending policies lead to the opportunity to live the life you want without falling deep into debt.

The second step in good personal financial planning is turning those policies into habits. If you stay dedicated to making your spending and saving policies a part of your every day decision-making process, then they begin to become second nature. You start to make decisions based on what is best for your personal finances, and you begin to develop the real understanding you need to stay out of debt.

To help you get started, there are five practical tips you can use that will help you avoid debt. Some pieces of advice are not as easy to follow as others. But when you put them together, you get a plan that can help you gain control of your finances and always have your head above water.

1. Budget Your Money

Monitor your spending for two months by keeping a log and collecting receipts. Then segment your spending into expense categories such as entertainment and food. Once you have that information, you combine it with your monthly bills to get a clear picture of your monthly spending habits. Before you start to develop a budget, analyze your spending to find ways to reduce your expenses and free up more money for savings and paying off bills.

Write your bills into a checklist and compare that to your monthly income. As you pay bills or use up expenses, check it off your list. Make your savings accounts bills that you pay every month. Vacations, holiday spending and an emergency savings account should all get something put into them to make sure you have the money when you need it. Any extra money you have at the end of the month goes into the savings account or is applied to paying down the balance of a credit account.

Remember to create expense items for your weekly entertainment, food and gas for your car. Anticipate one-time bills each month and account for them in your budget. Do not deny yourself money for going to the movies each week, but rather you should keep track of it and limit your spending to make sure you have money for important bills and expenses.

2. Make More Money

Is it practical to lower your monthly food budget or put off paying credit card accounts to try and apply that money to other things? No, that is not a practical solution. If you find yourself falling short on your budget each month, then the practical approach is to take on an extra part-time job, pay your bills down and then get your finances under control.

One of the difficult things about budgeting money and being practical with your personal finances is that you need to objectively look at your situation and make hard decisions. If you put yourself in a financial hole, then develop the initiative to get yourself out of that hole by making more money. If you can spend more money, then it is practical to expect yourself to also be able to make more money.

Even if you have a balanced budget and no money problems, if you have the time, then it may not be a bad idea to get an extra part-time job anyways. You can put the money you make into your various savings account and strengthen your financial situation even further. It can be difficult to anticipate the future, and that is why it is always a good idea to take prudent financial action when you are able. Adding money to your savings accounts when you do not feel you need it will create more available funding when you do need it.

3. Credit Cards

A discussion of credit cards is part of practical financial planning because credit cards can offer several benefits that a person with good spending habits can take advantage of. When you are applying for a credit card, look for one that fits your situation. If you travel a lot, then get a card that offers discounts in travel, hotels and rental cars. Look for the card with the best cash-back feature to help you put extra money into your pocket during the course of the year.

The most practical way to use a credit card that offers rewards and cash back is for items that you know you have the cash for in the first place. For example, if you use your credit card to buy groceries, then you can get the benefits of travel miles and cash back while you pay off your entire credit card balance with the grocery money set aside in your budget. Regular expenses that you know you have covered by cash are excellent candidates for credit card spending because you will not be carrying the balance from month to month, but you will still get the rewards credits.

Credit cards are also necessary when it comes to renting a car and doing other activities while traveling or on vacation. Once again, it is practical to have the cash ready to pay the credit card bill when you get it in 30 days. But if you can continue to rack up cash-back payments for spending cash that you have on hand, then that is a good financial move. If you pay the balance within 30 days, then you reduce your interest debt to almost nothing. Learn how to use credit cards responsibly to benefit from them.

4. Save Rather Than Spend

One of the ways that retailers convince people to make large purchases is to entice consumers with low monthly payments on financing. If you know that you can easily make a monthly payment on a financed item, then you should also be able to save the money needed to buy that item in cash.

For example, if you are not in a hurry to get a new television, then you should do some research and find out how much the television you want will cost. Then you can develop a savings plan that will help you to save the money you will need to purchase the item. Look at it as making payments on a finance account for an item you do not own yet. Once you reach your goal, you can purchase the item outright without having to pay interest and finance charges.

Saving money for purchases is always preferable to opening a finance account for the practical consumer. You may have to wait a few extra months for the item but, if the item is not a critical need, then saving for it will allow you to have the things you want without putting yourself into debt.

5. Do It Yourself

Spend time learning how to do tasks that you would normally pay a contractor or professional to do. For example, you can save some money each year by changing your own oil and taking the old oil to a local auto mechanic for disposal. If you have an interest in home remodeling, then start researching ways to do projects on your own rather than paying extra for a contractor to do them.

Any time you get a chance to save money by doing something yourself, the practical approach is to take that opportunity. If you go out to a company party at a facility where there is valet parking, then look to see if you can park your vehicle yourself to save the valet charges. Wash your vehicle each week in your driveway with your own water and supplies to avoid paying for a car wash.

Do not take the “do it yourself” approach to dangerous levels. If a family member needs medical attention, then get to a doctor. But if you find practical ways to save money by doing something on your own, then you should take the chance to save money and avoid putting yourself deeper into debt.

These were our best five tips to easily stay out of debt. Of course these aren’t the only things you could do to stay financially healthy! You can find more effective tips on these links we bundled for you. They’re a great addition to our relatively small website. Good luck!

Debt Relief Specialist wants to share a settlement letter from One Main Financial. Bal. $2342.52 Offer $710.00 Savings $1632.52

Debt Relief Specialist wants to share a settlement letter from Dell Financial. Bal. $852.06 Offer $342.00 Savings $510.06

Debt Relief Specialist wants to share a settlement letter from Stein Mart/Synchrony Bank. Bal. $6426.58 Offer $1730.00 Savings $4696.58

copyright 2024 Consumer Debt Help Association - 516 N. Dixie Highway, Lantana, FL 33462. All Rights Reserved