Consumer Debt Help Association, Debt Relief Specialist wants to share a settlement letter from Walmart/Synchrony Bank. Bal. $2271.60 Offer $454.32 Savings $1817.28

Consumer Debt Help Association, Debt Relief Specialist wants to share a settlement letter from Walmart/Synchrony Bank. Bal. $2271.60 Offer $454.32 Savings $1817.28

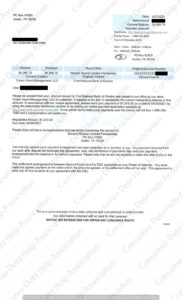

Consumer Debt Help Association, Debt Relief Specialist wants to share a settlement letter from First National Bank of Omaha. Bal. $4365.79 Offer $1310.00 Savings $3055.79

Consumer Debt Help Association, Debt Relief Specialist wants to share a settlement letter from One Main Financial. Bal. $9053.87 Offer $4527.00 Savings $4526.87

Consumer Debt Help Association, Debt Relief Specialist wants to share a settlement letter from Lowe’s/Synchrony Bank. Bal. $1293.51 Offer $258.70 Savings $1034.81

Consumer Debt Help Association, Debt Relief Specialist wants to share a settlement letter from Capital One. Bal. $11,443.96 Offer $4006.00 Savings $7437.96

Everyone has different needs, responsibilities, and spending and saving habits. Still, you may wonder how your spending lines up with everyone else’s.

Or, if you’re in the process of creating a monthly budget, you may be looking to see roughly how much of your take-home income you should be setting aside for various living expenses.

To help you get a better sense of the cost of living for one person, we’ve assembled a list of the most common average monthly expenses.

Housing

We generally all need a roof over our heads, and housing tends to consume the highest portion of monthly income.

Indeed, according to the U.S. Department of Labor, single people living alone (or with others but paying their own) may devote, on average, 35.9 percent of their monthly income to housing.

Government stats also show that the average household (from singles to families) spends about $1,723 per month on housing costs, including rent or mortgage, property taxes, maintenance and insurance fees, where applicable.

Of course, monthly housing costs may be less if you’re single, and can also vary significantly depending on where you live.

A single person living in a studio in New York City, for example, can expect to spend around $1,514 on rent, whereas someone renting a one-bedroom in Roanoke, VI, can expect to pay around $713 on monthly rent.

Transportation

Transportation costs can vary depending on your mode of transport (i.e., car vs. bus vs train), as well as what region of the country you live in.

But one thing that holds true for many of us–transportation often accounts for the second-largest budget item, after housing.

The average household shells out around $813 per month on transportation, including car or public transportation, gas, insurance and other related expenses.

Other transportation expenses to note:

• Americans spend an average of $550 per month on new car payments.

• Gas and fuel run around $176 per month on average.

• Car insurance payments average $119 monthly.

Health Care

Health care expenses can vary depending on each individual’s circumstances, and can also rise and fall from one month to the next.

For example, there may be some months where unexpected medical costs crop up (such as emergency care), and other months where you only need to cover insurance premiums and preventive care appointments.

Cost also varies by location.

For instance, a single adult living in New York City can expect to pay about $425 a month on health care (including insurance premiums for the lowest tier plan, as well as out-of-pocket costs).

A single adult living in Boise, Idaho, on the other hand, can anticipate shelling out roughly $342 per month for those costs.

Food

Everyone’s gotta eat–and the average single person spends about $198 per month in groceries and $172 per month outside the home, for a total average of $370 per month.

This figure can range, however, anywhere from under $200 to over $700, depending on your age, income, gender, eating habits, and where you live.

The wide variability in spending in this category shows that food can be an area where consumers can find savings if they need to reduce monthly spending (such as eating out less, meal planning, and choosing lower cost brands at the supermarket).

Cell Phone

Average monthly wireless fees run between $35 and $140 for a family plan.

The good news? If your budget is particularly tight, you could spend as little as $10 a month for basic service with no data.

Utility Bills

After you’ve saved up and carefully budgeted to buy a home, you probably don’t want to be surprised by a higher-than-expected utility bill.

A number of factors go into utility costs, including home size, where you set the thermostat, type of insulation you have, the climate, as well as what part of the country you live in (since rates vary across the country).

New Mexico residents, for example, pay the least for natural gas (on average, $50 per month) and electricity (an average of $79.16 per month), while Hawaiians pay the most–due to the remote nature of the islands, electricity averages $149.33 per month and natural gas averages $223.07 monthly.

Clothing

The average adult aged 25 to 34 spends about $161 on clothing per month. Adults aged 35 to 44 spend a bit more, averaging $209 per month.

If your budget is tight, this is one category where you can often pare back spending–whether by shopping your closet, hitting the sales racks, or bringing older clothes that need repairs or fit adjustments to the tailor.

Gym Memberships

The average gym membership runs $58 per person, which could be a good deal if you use it regularly.

But weighing in at $696 per year, it’s a hefty price to pay if you rarely see the inside of that gym.

There are some great options for exercising on a budget, such as going outside and hitting the pavement, joining an exercise meetup group, watching YouTube videos, and/or picking up some dumbbells and exercise bands to workout at home.

Getting Your Monthly Expenses in Check

Knowing the average cost of living can be helpful when you’re trying to determine how much of your budget you may need to allocate to different spending categories.

However these average monthly expenses are just that — averages.

To fine-tune your budget, and make sure your spending is in line with both your income and your goals, it’s a good idea to track your own spending (which means every cash/debit card/credit card payment and every bill you pay) for a month or two.

There are a few options for tracking spending. One easy method is to make all purchases for the month on one debit card or credit card, then, at the end of the month, taking note of all the purchases made.

Another option is to log expenses as you pay them–you can carry around a notebook or keep all your receipts and list them later on paper or in a computer spreadsheet.

At the end of the month, you can then tally up everything you spent, as well as allocate each expense into key categories, such as housing, transportation, food, health care, etc.

You can then see how your spending compares to national averages, as well as where you might want to tweak things.

For instance, if you don’t have enough at the end of the month to put any money away into your retirement fund and/or an emergency fund or other savings goal, you may want to re-examine your nonessential spending (such as restaurants, clothing, gym memberships) and finds some ways to pare back.

The Takeaway

Whether you’re creating a new budget or refreshing an old one, you’ve probably noticed how important–and tricky–it is to get your monthly expenses right.

Knowing the average amount people spend to live can help you figure out how your spending stacks up and, if you’re just starting out, help to ensure you’re budgeting enough for each category.

To see how your actual spending compares to national averages, you may want to track your daily spending for a month (or more), and then put all your expenses into categories.

You may then decide to set up certain spending limits to keep your spending in line with your income, as well as your savings goals.

copyright 2025 Consumer Debt Help Association - 516 N. Dixie Highway, Lantana, FL 33462. All Rights Reserved