Debt Relief Specialist wants to share a settlement letter from Care Credit/Synchrony Bank. Bal. $8614.82 Offer $2585.00 Savings $6029.82

Debt Relief Specialist wants to share a settlement letter from Care Credit/Synchrony Bank. Bal. $8614.82 Offer $2585.00 Savings $6029.82

Debt Relief Specialist wants to share a settlement letter from PayPal/Synchrony Bank. Bal. $2085.28 Offer $650.00 Savings $1435.28

Debt Relief Specialist wants to share a settlement letter from Capital One. Bal. $1737.42 Offer $434.36 Savings $1303.06

Debt Relief Specialist wants to share a settlement letter from Lending Club. Bal. $5423.13 Offer $1355.78 Savings $4067.35

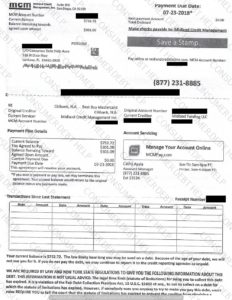

Debt Relief Specialist wants to share a settlement letter from Best Buy/Citibank. Bal. $752.72 Offer $301.09 Savings $451.63

Debt Relief Specialist wants to share a settlement letter from Target/TD Bank. Bal. $1526.63 Offer $764.00 Savings $762.63

Debt Relief Specialist wants to share a settlement letter from Dress Barn/Comenity Bank. Bal. $2155.02 Offer $538.76 Savings $1616.26

Debt Relief Specialist wants to share a settlement letter from Citibank. Bal. $6896.68 Offer $1724.17 Savings $5172.51

If you’ve been struggling to build up an emergency fund, you aren’t alone. According to the Wall Street Journal, one in four Americans has no emergency savings.

Maybe you’re stuck trying to figure out the best way to build up your emergency fund. We reached out to the experts to answer a few questions regarding ways to build up your emergency fund. Here’s what he had to say:

——————————————————

Q. How can you determine the ideal amount for an emergency fund?

A: The exact amount in your emergency fund is more art than science. You have to look at things like: How volatile is your job/income source? If you lost your job, how long would it take you to find a new one? Would that involve a move? Do you have a significant other who could help pay the bills if something happened to you? What is the deductible on your health insurance plan? All of these questions, and others, will play into how much you need to keep on hand. Three to six months of living expenses (not income) is the general rule of thumb, and I find that it applied to most clients.

———————————————————

Q. How would the paycheck-to-paycheck individual go about building his/her emergency fund?

A: If you are living paycheck-to-paycheck, you can look at both your income and expenses. Analyze your spending to be sure you are spending money in ways that makes you happy, not just blowing it on things you can’t even remember buying. Track your spending using a platform like Mint.com for a few months and see if you can find any areas to cut out of your budget. Also look at your income. Are there ways to make a little more money each month? It could be making more money in your full-time job or by starting a side hustle. You can use a hobby to earn additional money and set it aside into your emergency fund.

———————————————————

Q. Should individuals rely on interest-bearing accounts as a place to store the emergency fund?

A: Emergency funds need to be kept in cash, preferably in a savings account that isn’t directly tied to your day-to-day checking account. You want the money to be easily accessible, but you don’t want to see it every single day that you look at your bank account, because it might tempt you to spend some of it.

———————————————————

Q. Is it more important to establish an emergency fund or a retirement account?

A: Hands down, the emergency fund is more important. You shouldn’t be thinking about retirement savings at all until you have your emergency fund going.

———————————————————

Q. What are some unconventional tips you might offer for building the emergency fund?

A: I think we focus a lot on expenses, but really focusing on income and how to make a little more each month is a much better strategy in my opinion. You can only cut so many expenses, but there are a lot of ways to add income each month.

———————————————————

Saving an emergency fund may not be easy, but it is one of the more important steps you can take to take control of your finances.

Debt Relief Specialist wants to share a settlement letter from Chase Bank. Bal. $5869.00 Offer $2000.00 Savings $3869.00

copyright 2025 Consumer Debt Help Association - 516 N. Dixie Highway, Lantana, FL 33462. All Rights Reserved