Debt Relief Specialist wants to share a settlement letter from US Bank. Bal. $4618.92 Offer $2079.00 Savings $2539.92

Debt Relief Specialist wants to share a settlement letter from US Bank. Bal. $4618.92 Offer $2079.00 Savings $2539.92

If you’ve promised yourself that you want to pay off your credit card debt “when you have more money,” now’s your chance. The Internal Revenue Service estimates that 70% of taxpayers will get refunds this year. Last year, the average refund was $2,860, according to the IRS.

You have taken a huge step enrolling in our debt negotiation program, but the program can only work as fast as you can save funds. Using even a portion of your return to go towards your program will greatly improve the speed in which we are able to settle your account, with almost no effort on your part. In a 2016 National Retail Federation survey, about 39% of American adults said they planned to use their refund to pay down debt, why shouldn’t you do the same?

If paying off your debt faster is your goal, then you know what to do but you may want to use a portion of your refund elsewhere if:

You don’t have an emergency fund. Sock away at least $500 in your bank account before tackling your credit card debt.

This is important to have a safety net in the event that something out of the ordinary comes up.

Since your credit card debt is gnawing away at your monthly budget, here’s why tackling it now is your best call.

You’ll be out of debt faster

Being out of debt faster will get you out of the program faster. And you will no longer have the program payment monthly and will have that additional money every month to spend on other things or activities.

It could boost your credit

“Amounts owed” — that is, how high your balances are — accounts for 30% of your FICO score and is a “highly influential” factor in your VantageScore, Credit Utilization Ratio, or the percentage of available credit you’re using, is a major factor in amounts owed. As a rule of thumb, it’s a good idea to keep your balances below 30% of your credit limit at all times. The lower you can keep your balances, the better. Settling the remaining accounts in your program will greatly help with your Debt to Income Ratio.

Applying your refund to your credit card debt can help you reduce both your overall debt and your credit utilization ratio quickly. This can help your credit score, making it easier to qualify for more affordable credit products and even potentially helping you save on car insurance.

It’s a painless path to a fresh start

Sometimes, the most difficult thing about paying down debt is the “paying” part.

Because of a psychological effect called loss aversion, losses can loom larger in our minds than gains. That’s why it’s painful to see money leave your bank account — even if you know those extra payments are helping you in the long run.

When you pay down your credit card debt with your tax refund check, though, you get to pay down that credit card debt with “found money,” instead dipping into your savings. That makes it a little less painful.

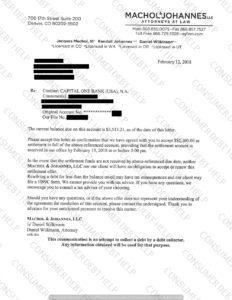

Debt Relief Specialist wants to share a settlement letter from Capital One. Bal. $3513.21 Offer $2100.00 Savings $1413.21

Debt Relief Specialist wants to share a settlement letter from Barclays. Bal. $11,894.96 Offer $4163.24 Savings $7731.72

Debt Relief Specialist wants to share a settlement letter from Sears. Bal. $4838.92 Offer $1936.00 Savings $2902.92

Debt Relief Specialist wants to share a settlement letter from Citibank. Bal. $2070.07 Offer $724.52 Savings $1345.55

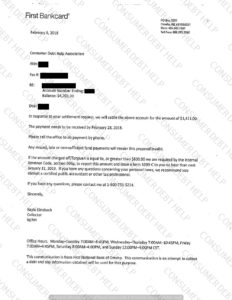

Debt Relief Specialist wants to share a settlement letter from First National Bank of Omaha. Bal. $4703.30 Offer $1411.00 Savings $3292.30

Debt Relief Specialist wants to share a settlement letter from PayPal/Comenity Capital Bank. Bal. $2668.97 Offer $802.00 Savings $1866.97

Debt Relief Specialist wants to share a settlement letter from Credit One. Bal. $3018.96 Offer $1056.63 Savings $1962.33

copyright 2025 Consumer Debt Help Association - 516 N. Dixie Highway, Lantana, FL 33462. All Rights Reserved