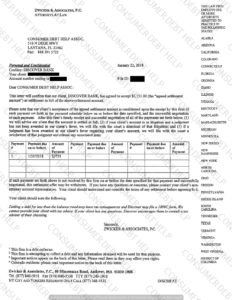

Debt Relief Specialist wants to share a settlement letter from Discover. Bal. $7498.61 Offer $3751.00 Savings $3747.61

Debt Relief Specialist wants to share a settlement letter from Discover. Bal. $7498.61 Offer $3751.00 Savings $3747.61

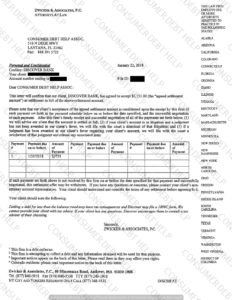

Debt Relief Specialist wants to share a settlement letter from Credit First Bank. Bal. $1073.01 Offer $536.51 Savings $536.50

Debt Relief Specialist wants to share a settlement letter from Credit First Bank. Bal. $892.48 Offer $446.24 Savings $446.24

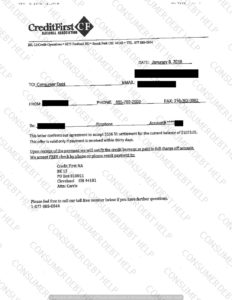

Debt Relief Specialist wants to share a settlement letter from Citizens Bank.

Bal. $3974.51 Offer $1589.81 Savings $2384.70

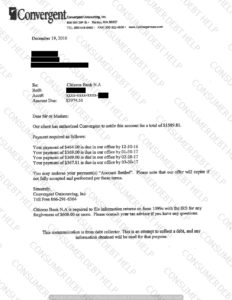

Debt Relief Specialist wants to share a settlement letter from Citizens Bank.

Bal. $2900.94 Offer $2088.68 Savings $812.26

Debt Relief Specialist wants to share a settlement letter from Dell Financial. Bal. $7559.97 Offer $3024.00 Savings $4535.97

No matter your life stage, managing your household budget is all about priorities–and trade-offs.

One of my friends wouldn’t dream of skipping his opera outings, even though his season tickets cost an arm and a leg. To make up for his periodic musical splurges, he doesn’t mind shopping at Aldi (in fact, he seems to rather like it) and handling his own landscaping and lawn-mowing.

For another person, however, that might be an unacceptable trade-off: Listening to music on CDs at home is just fine, thank you very much, if it means she gets to keep her landscaper and buy organic.

Finding the right balance between sacrifices and necessary splurges is a work in progress: Through a process of trial and error, individuals can identify which expenditures fall into the “must-have” category and which ones they can do without in a pinch.

In this column, I’ll discuss some ideas for cutting your day-to-day living expenses. Note that this isn’t an inclusive list, and a tip that’s right for one person might not be right for another. (That’s why some of these tips might seem to contradict one another.)

1. Go online or review sale fliers to see which grocery store has your favorite products on sale in a given week; just make sure that your savings cover any extra gas money when driving from place to place.

2. Buy frequently used items in bulk when they’re on sale; freeze items you won’t need soon.

3. Stock up during holiday season, when groceries often feature very low prices on basics like potatoes, onions, and baking supplies to get consumers in the door.

4. Resist the urge to overbuy perishables, even if they’re on sale. The most expensive groceries are ones you throw out.

5. Eat more vegetarian meals. You’ll likely save on grocery costs and accrue health benefits at the same time.

6. Make your own croutons, salad dressing, bread crumbs, granola, and pasta sauce. You can control the ingredients and they’ll taste better, too.

7. Grow your own produce: Start small with high-cost, high-margin items like herbs, and graduate to tomatoes, peppers, and zucchini.

8. Print out your own grocery coupons from sites like couponmom.com or your grocer’s website; you can also bypass print coupons and use a coupon app on your smartphone. This article summarizes some of the best sites and apps for grocery coupons.

9. If you live in a large urban center, shop at ethnic food stores, which may have good prices on basics as well as condiments that are often far more costly in a U.S.-style supermarket.

10. Packaged, processed food products are often discounted the most heavily, but don’t skimp on healthful food like high-quality produce and dairy items. Investing in your own health and well-being will pay for itself many times over.

11. Brown-bag or bring leftovers for lunch rather than buying your lunch.

12. By a refillable water bottle and forgo purchased bottled water. Brew your coffee or lattes at home versus going out for them.

13. Buy wine in bulk: Most stores offer a 10% discount on as few as six bottles, even if they’re not all the same type.

14. Cut back on alcohol and make nonalcoholic spritzers instead. (Cranberry juice and San Pellegrino, anyone?)

15. Make your own household cleaners. (Baking soda and vinegar have many cleaning uses, and are earth-friendly, to boot.) Good online recipes abound.

16. Shop discount warehouses such as Costco and Sam’s Club, but only if you won’t buy more than you need.

17. Conduct an audit of your warehouse club usage. If you’re only going a few times a year and you don’t need many of the bulk items on offer, it may not be worth it to pay for the membership.

18. Investigate services like Amazon Prime for subscription prices on recurring purchases like diapers.

General Merchandise

19. Watch out for shipping costs when buying on the Internet; they can quickly erode any savings you realize versus buying the item locally.

20. Services like Amazon Prime can help save time (and perhaps money), but be aware of how easy it is to put the “nice to haves” alongside the “must haves” in your shopping cart.

21. If you’re using an online shopping service such as Amazon Prime, check out what additional services go along with your subscription, such as streaming video or photo storage. You may be able to cut back on paid services in those areas.

22. When shopping for discretionary items, impose a cooling-off period. If you see something you want, wait a week. If you still want it a week later, then pull the trigger.

23. If shopping online, try a virtual splurge. The process of putting the items you want into your shopping cart may provide a shopper’s high, even if you don’t end up forking over your credit card.

24. Refrain from storing your credit card information on an online retailer’s website. Physically entering your information each time may cut down on impulse buys, and it’s also safer from a security standpoint.

25. Look for online coupons on sites such as retailmenot. Typing a retailer’s name into a search engine will also likely turn up a list of coupon codes for that firm.

26. Pay cash rather than using credit cards or checks. Having to hit the ATM and part with actual money can help discourage the desire to spend.

27. Minimize the amount of money you carry in your purse or wallet to help discourage spending on discretionary items such as coffee and magazines.

28. Have a garage (or basement) full of stuff you no longer need? Sell it on Craigslist or eBay.

29. Need stuff? Shop for items you need at flea markets, Craigslist, or eBay. Gently used or vintage items can be more distinctive than new ones, and giving items a second life is greener than buying new.

30. Hold a swap party with friends, where you all bring a few high-quality items that are no longer useful to you. Think kitchen equipment, decorative items for the home, clothes, or accessories.

31. Bargain when purchasing bigger-ticket goods such as appliances; you may have additional leverage if you’re purchasing more than one item.

Utilities/Telecommunications

32. Run appliances at off-peak hours when usage rates are lower.

33. Switch to CFL bulbs or dimmed lights (dimmed lights use less electricity, and may promote romance!).

34. Conduct an energy audit of your home (for example, check air leaks through window frames, door frames, and attics).

35. Turn down heat (or turn up your air-conditioning, depending on the season and the climate where you live). In colder climates, learn to love fleece and buy a warm comforter for your bed.

36. Switch from a premium cable package to a basic one or watch TV online via websites such as hulu.com. Purchasing a digital antenna will give you access to local network channels.

37. If you like your current cable package but it’s been getting more expensive, call your provider to see if you can take advantage of any discount packages available. If that fails, threatening to drop your package should get you results.

38. Head to your local library for DVD rentals; drop your Netflix subscription.

39. If you aren’t using items (such as lamps, VCRs, a clock radio in guest bedroom, and so on), turn them off or unplug them.

40. Switch to energy-efficient appliances when it’s time to replace (or even if it isn’t).

41. Only do full loads of laundry.

43. Hang clothes, sheets, and towels out on the line to dry in the breeze.

44. Fill your dishwasher before running it rather than cleaning partial loads.

45. Drop your phone landline and use your cell phone exclusively instead.

46. Conduct an audit of your cell-phone usage: Cut cell-phone minutes or switch providers. Light cell-phone users are likely to find a prepaid service is more cost-effective than an ongoing subscription. If you’re not a heavy data user, you may be able to get by with just using wi-fi to access data from your phone.

47. Consider sharing cell-phone service with family members or friends; you can usually add additional lines for a small charge per month.

Gasoline/Auto

48. Switch to a more fuel-efficient vehicle. This can be a particularly good idea if you log a lot of miles on the road, but it might not be cost-effective if you don’t drive as much.

49. If you don’t log many miles, investigate a car-sharing service, such as Zipcar, or rent a car rather than paying for maintenance and insurance for your own vehicle.

50. In lieu of taxis, use a service such as Uber or Lyft, which can be more cost-effective.

51. Bike or walk to your destinations, or use public transportation, rather than driving.

52. Take advantage of pretax benefts for users of public transit.

53. Wash your car at home rather than paying for car-washing services.

54. Check out websites like gasbuddy.com to find the lowest gasoline prices in your area.

Home Maintenance

55. Cut your own grass and tackle your own landscaping. You’ll save money and improve your fitness level, too.

56. Reduce your dependence on chemical-based lawn-maintenance services. Your grass might not be as perfect, but you’ll have more money in your pocket and fewer chemicals on your lawn.

57. Drop your house-cleaning service or switch from once-weekly service to once every other week.

Personal Care

58. Experiment with drugstore brands to replace expensive department-store cosmetics.

59. Do your own manicures and pedicures.

60. Stop buying dry-clean-only clothes; learn to iron instead.

61. Walk, bike, run, or work out at a community recreation center rather than paying gym fees.

Insurance/Financial Services

62. Ask if you can qualify for discounts by consolidating homeowners and auto policies with a single firm.

63. Shop around for the best auto and homeowners insurance rates rather than automatically renewing with your current carrier. (Just be sure to the check claims-paying ability and financial stability of a prospective insurer first, using sources like ambest.com.)

64. Ask for a loyalty discount if you decide to stick with the same insurer.

65. Think twice before making small claims on auto and homeowners insurance; the resultant bump-up in premiums could cost you far more than paying for the fix out of pocket.

66. Skip extended warranties. If replacing an item like a computer or a refrigerator wouldn’t put you in a financial bind, it’s usually not worth insuring it.

67. Be scrupulous about paying your bills on time–and not just your insurance bills. Those with the highest credit ratings will qualify for the most advantageous rates.

68. Never let your policies lapse; you may pay a surcharge to reinitiate coverage.

69. Raise your deductible on your auto insurance, especially if you have a history of safe driving and you can afford to pay for smaller fixes out of pocket. Drop or reduce the collision and comprehensive coverage on your auto policy if you drive an older vehicle or one with high mileage.

70. Raise your deductible on your homeowners insurance but ask for a comparison first; the decrease in your premiums may be negligible.

71. Make sure the your homeowners insurance provider is using a realistic value for your home’s replacement cost; the value of the land shouldn’t be included.

72. Live in a disaster-prone area? See if you can qualify for a reduction in homeowners insurance rates by making your home more resistant to natural disasters, such as earthquakes and hurricanes.

73. Ask your insurer if having a home-alarm system or sprinkler system qualifies you for a discounted insurance rate.

74. Paying extra to insure valuable personal articles like jewelry and collectibles? Make sure you still own the items covered. And even if you do, they might be covered under your basic homeowners policy.

75. Investigate what perks come along with your credit card, such as extended warranties or insurance on car rentals.

76. Switch to a credit card with no annual fee, especially if you’re finding it difficult to actually take advantage of the so-called rewards that your rewards card offers.

77. Investigate no-fee cards that pay you cash or rebates back on everyday purchases. Just be sure to read the fine print to ensure that your spending doesn’t have to hit a specific level before the cash-back offer kicks in.

78. If you carry a balance, call your credit card provider to ask for a reduction in your current interest rate. If that doesn’t work, transfer the balance to a card that offers a lower rate. (Just make sure to take stock of any balance-transfer, application, or processing fees; also make sure that your new rate isn’t a teaser rate that will shoot higher before you’ve paid off your balance.)

79. Travel overseas frequently? Avoid foreign transaction fees, which can run as high as 2% or 3%, by switching to a card that offers no foreign transaction fees.

80. Carry a balance on multiple cards? Consolidate those balances in the account that offers the most attractive rate. Again, be careful not to trigger new balance-transfer, application, or processing fees.

81. Investigate credit unions, which may offer higher yields and better loan and credit card rates than banks with a big brick-and-mortar presence (and more overhead expenses).

82. Don’t keep more in a non- or minimal-interest-bearing checking account than you need to; shop around for an account that doesn’t require a minimum balance and park the rest of your cash in a higher-yielding money market fund or certificate of deposit.

83. Ditto for paying fees on your checking account; at this point, it’s not difficult to find no-fee, no minimum balance accounts at firms such as Ally Bank. Online savings accounts can also be a great deal, often offering much higher yields than are available via conventional banks.

84. If you’d like to stick with your current bank but avoid extra fees, ask if your bank will waive fees if you sign on for additional services, such as electronic deposits of your Social Security checks or a money market account.

85. Don’t buy checks from your bank–use a service like Current or Checks in the Mail for low-cost checks instead.

86. Avoid overdraft fees by keeping close tabs on your monthly balance or linking your savings account to your checking. Opt out of overdraft protection, which means that the bank will cover you–and charge you a hefty fee–if you overdraw your account.

87. Watch ATM fees, either by sticking with your bank’s ATMs or opting for a bank that will offer rebates if you use an out-of-network ATM.

88. Pay bills online to save on stamps.

89. Don’t pay for tax-preparation services, especially if you have a straightforward tax return. Many communities offer free tax-preparation assistance.

90. Beware of “rapid refund” offers from tax-preparation firms, which are little more than high-interest loans. If you file your taxes electronically, your refund will come more quickly than you might think.

91. Don’t use prepaid credit cards as gifts for friends and family. Fees can be very high, and cash is much more flexible.

92. Consolidate your investments with a single firm so that you may qualify for lower-cost share classes and lower commission rates.

93. Do you have a small brokerage account that you haven’t touched since the dot-com bust? Close it or add more money to it to avoid ongoing account-maintenance and inactivity fees. Better yet, shop around for a brokerage that doesn’t charge any fees to maintain an account.

94. Don’t overpay for mutual funds. For bond funds, setting an expense ratio cutoff of 0.75% will still keep plenty of good options within reach. You can find many worthy stock funds for 1.00% or less–preferably much less. Index funds and exchange-traded funds, many of which have expense ratios of less than 0.25% per year, are especially appealing from a cost standpoint.

95. Use a low-turnover strategy to reduce the toll that commissions can exact on your investment account’s bottom line. If you actively trade a portion of your portfolio, switch to a provider that offers free online stock and ETF trades.

96. Use limit orders when trading low-liquidity securities to avoid being gouged by large bid-ask spreads; such orders ensure that you’ll only pay a specific, predetermined price for any securities you’re buying.

97. Don’t pay for more financial-planning advice than you actually need. If you need help with a specific task, such as a one-time portfolio overhaul, the hourly model will be more cost-effective than paying a percentage of your assets on an ongoing basis.

98. If your company-provided health savings account custodian levies a lot of fees or fields only high-cost funds, regularly switch out of that HSA and into one of your choosing, as discussed here.

99. Ask for very specific annual cost estimates before signing on for a complicated and costly financial product, such as a variable annuity. If you’re seeing costs of more than 2% or 3% per year, ask your financial advisor whether there are cheaper ways to achieve the same general goals.

100. Mind the tax drag of non-retirement accounts. When selling winning holdings from your taxable account, scout around for losers you can sell to offset the capital gains. Choose tax-efficient holdings for your taxable account, including broad-market index funds and ETFs, tax-managed funds, and municipal bonds and bond funds. Rebalancing? Focus on your tax-sheltered accounts to avoid triggering an unwanted capital gains tax bill.

The way that you manage your credit card debt can have a profound effect on your credit score. Some behaviors affect the equation output only temporarily, while others stain your consumer report for seven or ten years, and drag your rating down the entire time.

Therefore, it is important to know which factors affect your score temporarily, and which do damage that is more lasting. Banks report balance amounts monthly, so the amount owed is temporary, and can change quickly.

When Credit Card Debt Hurts your Score

Having large amounts of credit card debt hurts your credit score far more than it helps. You need to borrow money in order to give the equations some data to make a reliable prediction of future payment performance.

However, carrying large revolving balances is not the type of behavior that demonstrates financial stability. High utilization ratios suppress your ratings.

Utilization Ratio

High amounts of credit card debt increase your revolving balance utilization ratio, which hurts your score. You calculate the revolving balance utilization ratio by dividing the total revolving balances by the total limits into all your revolving accounts.

Most credit cards are revolving accounts. You have the option of paying any amount above the minimum payments. Charge cards require payment in full every month and do not fit the definition.

A high utilization ratio tends to hurt your score. A high utilization ratio is a sign of trouble brewing on the horizon. One unexpected expense, one job loss, or one episode of disability and everything comes tumbling down.

Paying Credit Card Debt Improves your Score

The best way to improve your credit score is to pay down the credit card debt that appears on your consumer report. The equations consider the total balances and utilization ratios based upon what appears on your file.

The key to improving your score then lies with lowering the amount of debt that appears on your consumer report. You can achieve this through consolidation, Debt Settlement or by paying the account in full while reducing or stopping new charges.

Consolidation Programs

Credit card debt consolidation programs may improve your score, provided you stop spending, and do not run up a new balance on your revolving accounts. Several things occur when you consolidate. Some factors lower your number while others lift it higher.

The lender will log a hard inquiry when reviewing your application. Hard inquiries will suppress your score temporarily on the bureau report used by the lender.

If approved, the lender will report the new installment loan account to each of the three bureaus. New accounts can two different effects.

•Lower the average age of your accounts, which helps.

•Improve your account mix, which tends to hurt.

When you conslidate your credit card debt using a debt using a personal installment loan, the bank then reports a new payment status, and smaller amounts owed.

•A paid as agreed status is better than a delinquent status, which immediately improves your rating. Payment history comprises 35% of your number.

•Your total revolving balances, and revolving utilization ratio will drop, which tends to improve your rating. Revolving utilization comprises 30% of your number.

Paying Balances in Full

Paying your credit card balances in full every month may have no effect on your score at all. By paying the balance in full every month, you no longer incur interest charges. Paying interest does not affect your rating, but the balance amount reported by the bank does.

Paying your revolving balance in full does not guarantee that the bank will update your file with a zero balance. The bank updates your balance at the end of each billing cycle, before it processes your payment. When the bank receives your payment twenty days later, new charges may have accumulated on the account. As long as you keep charging on the account, you never reach a zero balance.

Debt Settlement

Debt settlement is a debt repayment strategy where you negotiate with your creditors to accept a partial payment as full satisfaction for the debt. If the creditor agrees, you pay just a percentage of your outstanding balance and the rest of the debt is cancelled for good.

You Can Avoid Bankruptcy

The biggest reason that people choose debt settlement is to avoid bankruptcy. Bankruptcy is a debt solution that will follow you for the rest of your life. The bankruptcy entry remains on your credit report for 10 years, but many loan, credit card, and job applications ask if you’ve ever filed bankruptcy. If you answer no and the bank later finds out that you actually did file bankruptcy, you could be found guilty of fraud. In the case of employment, you could lose your job.

Settling debts with your creditors, when it’s done right, can help you avoid filing bankruptcy and dealing with the consequences of a bankruptcy.

Debt settlement will only stay on your credit report for seven years.

There’s no public record of you ever having settled your debts, so once the credit reporting time limit has run on your settled accounts, you won’t have to deal with the settlement anymore.

Relief From Overwhelming Debts

The goal of debt settlement isn’t to get over on your creditors by paying them only a portion of the debt you accumulated.

So it’s unwise to rack up a large amount of credit card debt with the expectation of settling it all.

If you’re legitimately having trouble paying back what you owe, debt settlement may help you. Once you’ve negotiated and paid your settlement, you’re essentially debt free in less time and at a lower cost than if you tried to pay off your debts on a typical repayment schedule.

Comparing debt settlement to bankruptcy, creditors may not get as much from you even if you filed Chapter 13 Bankruptcy. They may not get anything at all if you file Chapter 7, even though it is nearly impossible to get approved for a Chapter 7 these days, creditors know the risk and this is why they accept settlement offers.

What happens when you find an inquiry on your credit reports and you don’t think it’s accurate? The typical response to a consumer’s question about getting an inquiry removed from his or her credit report is, “It can’t be done.” While that’s generally true, there are some exceptions, as our reader Kris learned.

Here’s what happened. He received a pre-approved credit card offer in the mail. He thought it came from his current card issuer, Capital One, but didn’t realize it was from another lender whose name and logo appear quite similar. He applied and was offered a card with a $300 credit limit, which surprised him. “It baffled me why I would qualify for something so low when I know I have good credit,” he says. That’s when he looked a little closer. “After I read the terms more closely and saw the interest rate was high and everything about them was terrible, I finally made the full connection,” he says.

So he called that issuer and asked them to cancel the application. He also went one step further and asked them to remove the inquiry as well, since he felt like he was essentially tricked into applying. The first person he talked to was noncommittal about removing it, so he asked to speak with a supervisor. “To their credit, the call lasted maybe 20 minutes or so, for what I expected to last probably at least an hour because removing a credit inquiry is extremely difficult to get removed,” he notes.

Kris says he’s pretty savvy about credit. In fact, he has often given others advice about how to improve their credit scores. So he knew the inquiry wouldn’t significantly affect his scores, but he was planning on applying for a home loan, and didn’t want to see his scores lowered — especially given the circumstances.

By way of background, the Fair Crediting Report Act requires credit reporting agencies, when they provide credit reports to consumers, to disclose the identification of each person that “procured a consumer report for employment purposes, during the 2-year period preceding the date on which the request is made; or for any other purpose, during the 1-year period preceding the date on which the request is made.”

“We are required to list an inquiry for every instance the consumer’s report is requested. Doing so ensures the person has a complete record of who has reviewed the report,” says Rod Griffin, director of public education for Experian. “That can be important if, for example, the person is a victim of fraud and their identity has been used to apply for credit. The fraudulent inquiry may tip them off to the fact that they are a victim.

Equifax has a similar policy, says Meredith Griffanti, Equifax’s senior director of public relations. “Inquiries are generally a matter of fact. Under the FCRA, a credit reporting agency must retain a record of companies who have accessed your credit report. Equifax’s guideline is to retain most inquiries for up to two years, although some are maintained for just one year. If you have a question or dispute with a specific inquiry, it is best if you contact the specific company that requested your credit report,” she says.

Fraud, however, may be one situation where a consumer may be able to get an inquiry removed. “Inquiries are always removed in the case of fraud,” says David M. Blumberg, public relations director at TransUnion. “Additionally, a consumer may request that a credit grantor remove an inquiry that was done in error.”

Griffin says that Experian “can remove inquiries identified as fraudulent,” adding that “other inquiries that accurately represent a request for the person’s report cannot be removed except by the source of the inquiry when it was made incorrectly or inadvertently.”

Is It Worth It?

Whether or not it’s worth going to the trouble of trying to get an inquiry removed depends largely on the situation. If there are multiple inquiries listed on your credit reports as a result of identity theft, it may be worthwhile to challenge them. But removing one or two inquiries may not be worth the time and effort involved. And the few points that you gain as a result could quickly be offset by other changes in credit scores, which fluctuate. Keep in mind that even if you don’t successfully get them removed, they will be gone in a year or two, and most credit scoring models ignore those that are older than 12 months.

Also keep in mind that only hard inquiries affect your scores, and even then, some may be grouped so they count as one (certain mortgage, student loan and auto loan-related inquiries, for example). And checking your own credit score does not affect it.

In the end there are often other factors that have more of an impact on your credit scores. If your goal is to get a good credit score, you may want to shift your attention to those that have a greater impact. (You can find out how inquiries and other factors may be impacting your credit scores with a free credit report summary from Credit.com.)

“Attempting to remove a credit inquiry from a credit report is like trying to get student loan debt discharged in a bankruptcy petition,” says Kris. It can be very difficult, but not impossible. “The moral of the story is that it never hurts to ask,” he says. “You have nothing further to lose and the potential of everything to gain. If you know what your talking about and what to say, what to ask for and who to talk to, then you’re off to a great start and probably a short journey with less bumps and a good outcome.”

While “Mo Money Mo Problems” may be the anthem for famed rap stars, hotel heiresses and other multi-millionaires, the rest of America could use a little extra just to meet monthly expenses. These suggestions can help you manage your money and stay on top of your rent and bills:

Create a Budget

Whether you’re in debt or simply trying to stay on top of your bills each month, one of the first things you should do to get your monthly expenses in order is to create a budget. Begin by calculating your monthly income, then determine your expenses, including rent, utilities, student loans, credit card payments, food, toiletries, household items and other necessities.

You should also take your spending money into account, subtracting from your total income how much you spend on going out and other unnecessary costs. If you find that your outgoing money is more than your income, it’s time to cut something out or find a new way to make up for the gap. We attached a budget form to this email.

Ditch the Paper

Online banking isn’t the way of the future — it’s now. Rather than having your bills mailed to you at home where you’ll need to juggle and keep track of physical copies, have them sent straight to your email inbox. You can even create a folder in your email account that contains only your statements and bills.

Don’t forget to back up these documents by storing them on the cloud or a storage device in case there’s an issue with your email provider. Another big perk for the environmentally conscious is that going paperless significantly reduces your carbon footprint.

You can also ask your landlord about paying your rent electronically, which not only saves trees but can make it easier to pay on time every time, since you can do it from with convenience on your own laptop.

Set Up Auto-Pay

It can be hard to stay on top of your bills when you have so many. Fortunately, online banking technology has advanced to the point where you don’t even have to log on every week to pay your electric, gas, credit card and other bills.

Contact your financial institution to set up auto-pay, which generally requires that you provide each of the companies with your banking information. The money will then be automatically deducted from your account on the set dates.

Keep in mind that using your bank’s auto-pay feature doesn’t mean you don’t have to do any work — you’ll still need to manage a budget and ensure that there are enough funds available to cover the amount on each deduction date.

Give Yourself an Allowance

Limit the amount of money that can be spent on the non-essentials, such as going out on the weekends and small pleasures (coffee in the morning and Friday lunches with your coworkers can add up fast). Keeping your budget in mind, give yourself a specific amount that you are allowed to spend on these luxuries.

Be strict with yourself: If you use up the last of your spending money on ice cream after work Thursday evening, you must wait until your next allowance to start spending on non-essentials again, which may mean packing your lunches at home and skipping on Thursday night bowling. This tactic will not only help you control your spending, but it may also help you embrace those small pleasures even more.

Save for a Rainy Day

Last but certainly not least is adding to your savings account on a regular basis. You should think of your savings deposit as a necessary bill rather than an afterthought or something you do with extra income at the end of the month.

It can be hard to find ways to save money, especially for those on tight budgets or with high monthly expenses. However, setting aside a small percentage of your paycheck, even if it’s only $ 20 per month, can be an enormous help if something unexpected comes up, such as a medical bill or emergency car repair. This financial cushion also provides a little peace of mind.

copyright 2025 Consumer Debt Help Association - 516 N. Dixie Highway, Lantana, FL 33462. All Rights Reserved