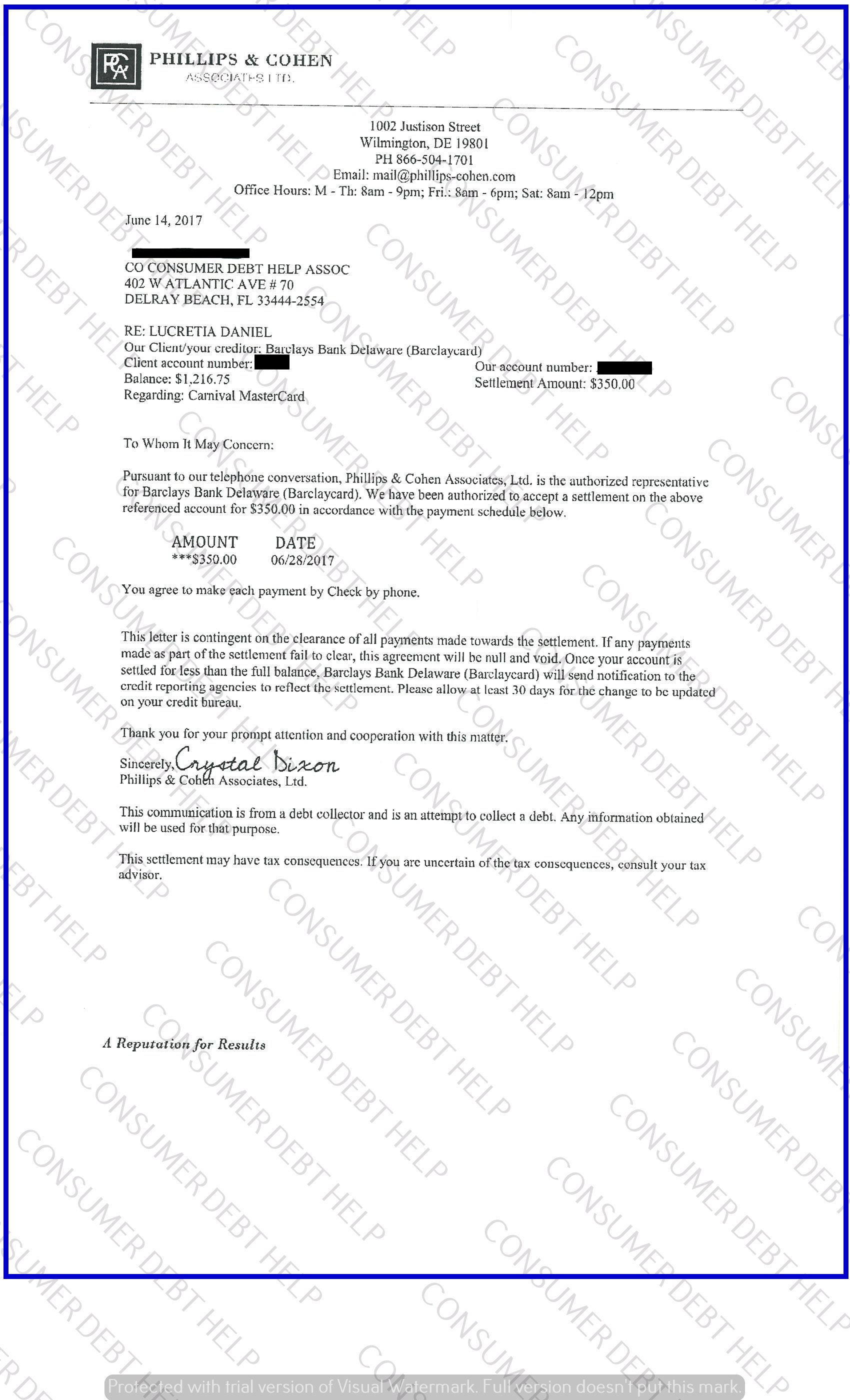

Debt Relief Specialist wants to share a settlement letter from TJ Maxx/Synchrony Bank. Bal. $2416.50 Offer $623.38 Savings $1793.12

Debt Relief Specialist wants to share a settlement letter from TJ Maxx/Synchrony Bank. Bal. $2416.50 Offer $623.38 Savings $1793.12

Forensic Analysis of Debt Settlement Program Participants, Commissioned by the American Fair Credit Council, Validates Economic Benefit to Consumers

Debt Settlement Produces Real Results for Americans Struggling with Unsecured Debt

Fort Lauderdale, FL – February 21, 2018 – The results of a six-year study of consumers enrolled in debt settlement programs, commissioned by the American Fair Credit Council (AFCC) and performed by the Certified Public Accounting firm of Hemming Morse LLP, once again shows consumers realize financial benefit from debt settlement program participation. Furthermore, the study illustrates that consumers have realized greater benefits since regulation of the industry went into effect in 2010. The most recent report, the third of its kind since the AFCC first commissioned the study back in 2012, tracks the outcomes of over 400,000 clients in 2.9 million accounts enrolled in debt settlement programs during the period January 1, 2011 to March 31, 2017.

The 2017 study represents the most comprehensive, forensic analysis of its kind, and documents the economic benefit consumers received as a result of their participation in debt settlement programs over the past decade. The study revealed several positive findings for consumers seeking relief from the burden of credit card debt. Most notable among the findings are that consumers are receiving financial benefit in the form of debt reduction resulting from regulations imposed on the debt settlement industry through the Revised Telemarketing Sales Rule in October of 2010 by the Federal Trade Commission and The Consumer Financial Protection Bureau. For consumers struggling with unsecured debt, the data clearly shows that debt settlement offers significant advantages compared to other options. Key takeaways include:

• Debt settlement on average saves consumers $2.64 for every $1 in fees paid

• More than 95% of debt settlement clients receive savings in excess of fees

• Most consumers see initial account settlements within 4-6 months of program start

• Debt settlement clients pay no fees until settlements are completed

Robby Birnbaum, President of the AFCC commented, “This report validates what our association and its members have known for years; debt settlement programs can offer struggling consumers a proven path to improved financial health. While not for everyone, these programs offer consumers tremendous benefit and an important lifeline towards an improved balance sheet and financial stability.”

For more information or to obtain a copy of the report, visit the American Fair Credit Council’s website at www.americanfaircreditcouncil.org.

About The American Fair Credit Council

The American Fair Credit Council (AFCC) is the leading association of professional Consumer Credit Advocates. The AFCC, and its member companies, work to represent the rights of consumers struggling with the overwhelming burden of debt. The AFCC has developed a strict Code of Conduct centered on best practices designed to protect the rights of consumers and require member companies to follow strict regulatory guidelines for operation. All AFCC members operate on a “No Advanced Fee Model” and never charge a fee for services until a consumer’s debt has been successfully negotiated.

Contact:

Robby Birnbaum – President

The American Fair Credit Council

Phone: (888) 657-8272

Website: www.americanfaircreditcouncil.org

Email: admin@americanfaircreditcouncil.org

About Hemming Morse LLP

Founded in 1958, Hemming Morse, LLP is a national firm leading the accounting industry in Forensic and Financial Consulting Services, as well as Financial and Compliance Auditing of Employee Benefit Plans. Based in California, with more than 100 employees working from offices in San Francisco, San Mateo, Los Angeles, Walnut Creek, Santa Rosa, Fresno and Chico, Hemming Morse handles complex and high-profile assignments that are local, regional, national and international in scope.

It’s probably something you tell yourself every January: “This will be the year I finally get my finances in order.” If that’s the case you’re certainly not alone. Last year over 30% of Americans said that their New Year’s Resolution was to “spend less and save more.”

The problem with resolutions like “spend less and save more” is how vague they are. In order to achieve your goals you need an actual gameplan. So if you really want to make 2017 the year you stop living paycheck to paycheck, bid adieu to your debt, and ultimately master your money, here is a guide to turning your resolution into a reality!

Building Your 2018 Budget

Before you can get to work paying off your debt or building up your savings you must first create a solid budget to lead you on the way. Having a budget in place will not only open your eyes to how much you spend on unnecessary things but will also help hold you accountable and on track toward achieving your goals. That’s why it’s a great idea to get the work out of the way now and make sure you have your budget in place for the new year.

Getting Started

The first step in creating any budget it to analyze your current spending. After all, how can you make changes if you don’t know what to work on? Typically it’s a good idea to look at your last three months of spending as a starting point. Be sure to grab all of your credit card statements, debit card transaction logs, pay stubs, utility bills, and whatever else you need to calculate exactly how much you made, how much you spent, and where that money went to.

Once you have all the needed documents, you’ll want to make a list of what categories your spending falls into. For example “entertainment” could be a single category or you could divide it up into “movies” “dining” and others if you wanted. The goal with this is to understand what you spend your money on and where you can make cuts. Also don’t forget to include your essentials such as rent, a mortgage, car payments, utilities, and other important bills.

With your categories decided on, add up all of your spending in each area for a given month. Then do the same for the other months you have data for so that you can arrive at an overall average. Repeat this for each category until you’ve accounted for all of your monthly spending. After that it’s time to look at what those numbers mean.

50/30/20 Rule

Now that you know where your money goes to it’s time assess where it could be better spent. If you’re like many Americans you may be able to “afford” your current lifestyle but leave little room for error. That’s where the 50/30/20 rule comes in.

The 50/30/20 rule states that no more than half of your income should go toward essentials such as housing, utilities, food, insurance, and other items that you absolutely must pay. Then the 20% refers to how much you should be saving, including emergency funds, retirement, and everyday savings accounts. This leaves you with only 30% of your income to spread across your various other categories. As a result you may learn very quickly that your current budget (or lack thereof) needs a major overhaul.

While that may seem straightforward enough, one common question is what category paying down existing debt falls under. The answer: it’s really up to you. While some experts say you can include debt payments in your 20% it may be worth finding places to cut back in your “30%” categories and using the money for debt repayment instead.

Lastly don’t forget about bills that may only come quarterly or annually that you may not have factored into your budget. To help account for this you can divide the amount by 12 (or however many months it takes before the next bill comes) and set that money aside each month. Similarly keep in mind that electricity bills and the like are subject to fluctuate from month to month. It’s usually a good idea to figure out what the highest amount will be for the year and use that number for your monthly budget. That way you won’t get caught off guard during an expensive month.

Making Adjustments

You’ve probably been told over and over again about how important it is to stick to your budget. While that’s certainly true, one thing that not many people discuss is that it’s okay to make adjustments to you budget down the road. In fact it will likely become necessary to do so.

There are several factors that could lead you to reevaluate your budget including a raise, a new job, or just a change in preference. Say, for example, that your business moves to a new office closer to your home — you may decide to move some of your gas budget to entertainment or another category. Plus as I mentioned it is always a good idea to save more if you can, so don’t stop looking for opportunities to stash your cash.

Getting Out of Debt

The debt in enrolled in the program will be handled to the best of our ability here at Consumer Debt Help Association but if you have debt that you left out of the program it would be a good idea to get those accounts down to a zero balance as well. The best way outside of the program to get your debt knocked out is called the “Snowball Method”. With this method you will figure out an amount of money that you can put towards paying these accounts off monthly. This amount needs to be more than the minimum payments on the accounts, the more you can put towards them monthly the better off you are. Then you will pay only the minimum payment on every account but the account that you are paying the most interest on. Once that account is down to a zero balance you will want to take the full amount of money that you were paying on that account and now put that amount along with the minimum amount due on the account that you now are paying the most interest on. You will do this roll over technique until all accounts are at a zero balance.

How to Stay Out of Debt

While getting out of a debt is a great feeling, sadly all too many people start to fall back into the traps that landed them in trouble in the first place! To avoid letting this happen to you, there are a few things you should consider.

One of the most important tools for preventing debt is an emergency fund. An emergency fund is a collection of savings that will help through tough financial times such as the loss of a job, a major illness, or other unforeseeable issues. It’s recommended that you stash away enough to cover three to six months of essential bills just in case. Additionally you might also want to maintain a “rainy day fund” which can be used to cover unexpected expenses of a less serious nature such as car repair, new appliances, etc.

Of course, in order to stay out of debt, your habits are what really need to change. However, contrary to popular belief, this doesn’t mean swearing off credit card entirely. Instead you should switch up your approach to credit.

Most people think of credit cards as a tool for purchasing items they can’t afford upfront, which is exactly why they end up in debt. Cards should instead be used as a tool to show creditors that you’re a responsible borrower. That is to say that you should pay off your credit card balance in full every month going forward and never buy anything on your card that you couldn’t afford to buy in cash. By sticking to this way of thinking you’ll not only help keep yourself out of debt but should also see a major improvement in your credit scores.

Making the Most of Your Money

A funny thing happens when you create a budget and pay off your debt: suddenly you’re in charge. This means that your money now works for you instead of the other way around. By taking proper advantage of this, you’ll be able to save even more money.

Investing and Retirement Savings

Now that you’re in charge of your money you can stop worrying about your day to day financial needs and start planning for the future. Naturally this includes focusing on retirement and ensuring that you have enough saved for when you leave the workforce.

If you’re not already doing so, one of the best ways to boost your retirement savings is to contribute to a 401(k) plan through your employer. Not only do 401(k)s make it easy to save money automatically and without much pain, but they could also mean some free money for you. That’s because several employers offer a certain amount of matching funds and perhaps even profit sharing on 401(k) contributions. While the terms of matching will vary, this often means you can earn a couple of extra percentage points on your savings. Keep in mind that, while you’re entitled to retain all of your contributions should you leave your current company, matching contributions and profit sharing may be subject to vesting, meaning you need to stay with the company for a set amount of time before that money is yours. For answers to questions about your employer’s 401(k), it’s best to speak with whoever is in charge of the plan at your company.

In addition to your 401(k) it’s a good idea to have your own, personal retirement account. This typically means opening an IRA (individual retirement account), which can be invested in money markets, stocks, bonds, etc. While most IRAs opened through a bank or other financial firm have limits on what types of investments you can make, there are now self-directed IRAs that allow you explore alternative investments and other opportunities, while also enjoying the tax benefits of retirement accounts. Finally you should also consider a ROTH IRA, which allows you to pay taxes on your contributions up front. The benefit here is that you’ll then be able to make tax-free withdrawals from your account after you’ve reached retirement age.

Credit Card Rewards

Once all your debt is taken care of and your credit score comes back up you can start looking at credit card rewards as a tool for good and use credit wisely not as to put yourself back in the same situation as you are currently in. In fact, once your credit scores improve, you may even be eligible to start being rewarded for using certain cards. There is no shortage of rewards credit cards out there and determining which one is best will depend on your spending as well as your interests.

One of the most popular options for a rewards card is one that offers you cash back on your purchases. Some cards may give you a flat rate on all of your purchases regardless of what the item is while others may offer better percentages in certain categories like gas or dining. Because of this it’s a good idea to take a closer look at your spending to see which one will ultimately save you the most.

Other rewards cards work on a points system rather than a straight cash back amount. Typically this structure is associated with travel cards that earn you frequent flier miles. Travel cards can either be branded with a certain company or be more generic, leaving you the choice to embrace loyalty or freedom. Earning travel rewards from credit cards has become almost a cottage industry. If travel is one of your interests then there are great Travel Rewards available.

If and when you do decide to jump into the world of rewards credit cards, there are a couple of things to watch out for. First some cards do charge an annual fee, meaning you’ll have to pay upwards of $100 per year in order to use the card and earn rewards. Even if they waive this fee for the first year, keep in mind that it will come around in subsequent years and that canceling a card may hurt your credit scores. You should also consider the other perks a card offers beyond miles or cash back, including loyalty status, no foreign transaction fees, concierge service, etc. In some cases these perks may put one card ahead of another one that might initially look better on the surface.

Despite whatever failed attempts you’ve made in the past, 2018 can be the year that you turn your finances around. However the key to success is having a strong plan in place. Before the new year arrives, set yourself up for success by building a proper budget, mapping a way out of debt, and preparing to enjoy the perks that come with mastering your money. Here’s to 2017 being the best financial year of your life.

Debt Relief Specialist wants to share a client review from today

“I don’t know where to start. But OMG! I have no more credit card debt. Thanks to Consumer debt. I was about $90,000 in debt, could not sleep, paying everything late, making the minimum payment which was interest only with no relief in sight. Thanks to the wonderful team at Consumer debt that supported me and help me even when I needed an extra week to make a payment to them when emergency arrive. Also a special thanks to Carol Trigueno for always being their for me.”

Mike

Debt Relief Specialist wants to share a client review from today

HERE I WAS IN MY LATE SIXTIES EARLY SEVENTIES WITH CREDIT CARDS THAT I

WAS BEGINNING TO BE UNABLE TO PAY. THE INTEREST ON THE CARDS WAS EATING

US ALIVE. WE NEEDED HELP WITH OUR FINANCES. WE CONTACTED CONSUMER DEBT.

THEY WORKED WITH ME TO STOP MY INTEREST ALONG WITH CONTACTING MY CREDIT

CARD COMPANIES. A REPAYMENT PLAN WAS WORKED THAT I COULD AFFORD. ONE

CREDIT COMPANY FORGAVE THE DEBT AND ANOTHER BROUGHT ME TO COURT FOR

WHICH CONSUMER DEBT HANDLED FOR ME. THEIR ATTORNEYS WORKED AN AGREEMENT

WITH THEM FOR PAYMENT. IT TOOK SOME MONTHS FOR US TO COMPLETE THIS

PROCESS HOW EVER CONSUMER DEBT WAS WITH US ALL THE WAY. WE ARE GLAD THAT

WE SOUGHT OUT RELIEF WITH CONSUMER DEBT. I RECOMMEND THIS COMPANY TO ALL

THAT FIND THEMSELVES OVER LOADED IN DEBT.

RICHARD & MARY ******

copyright 2024 Consumer Debt Help Association - 516 N. Dixie Highway, Lantana, FL 33462. All Rights Reserved